Author

Neil Schwartz

President, SBRnet, Inc.

Topic

- Consumer Behavior/Understanding

- Research

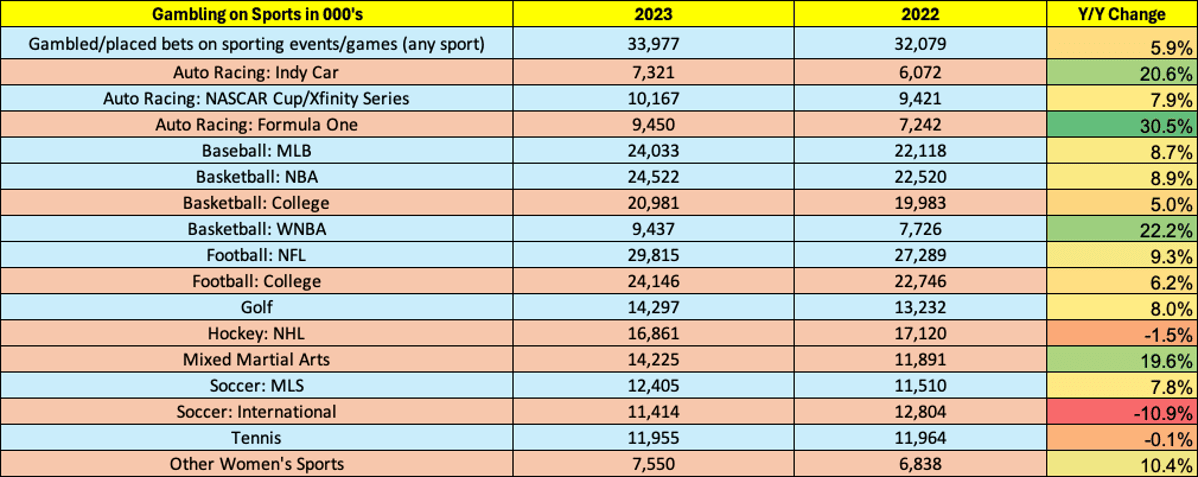

Gambling on sports has become a significant part of the sports fandom experience over the past decade. Since 2020, the number of sports gamblers in the post-pandemic era has grown from just over 23 million bettors to nearly 34 million in 2023. This represents close to a 50% increase in the number of fans placing bets on sports since 2020. In the last two years, we have observed a growth of almost 6 percent in the number of sports gamblers. Much of this growth has been driven by the rise of online sports gaming platforms like DraftKings, FanDuel, and BetMGM.

As of January 1, 2025, 38 states offer some form of sports gambling through a combination of brick-and-mortar and retail operations, and 30 states allow some form of online sports gambling. In the next two years, an additional four states are likely to approve online sports gambling. Texas and California are the two largest states without online sports gambling, both with an extensive history of sports fandom.

While the NFL has the largest fanbase who gamble by a long shot, fans of auto racing, women’s sports, golf, and MMA outperform the benchmark gambling numbers for all other sports measured in the SBRnet annual study of sports fans.

While the number of sports gamblers has increased, the total number of bets has not grown at the same pace. On average, there are 190 million bets placed yearly by 34 million sports bettors. This means that each sports gambler places an average of 5.6 bets throughout the year. Notably, the number of bets placed by each sports gambler is half of what it was in 2021 when online gambling was just beginning to ramp up. For many, it is no longer new.

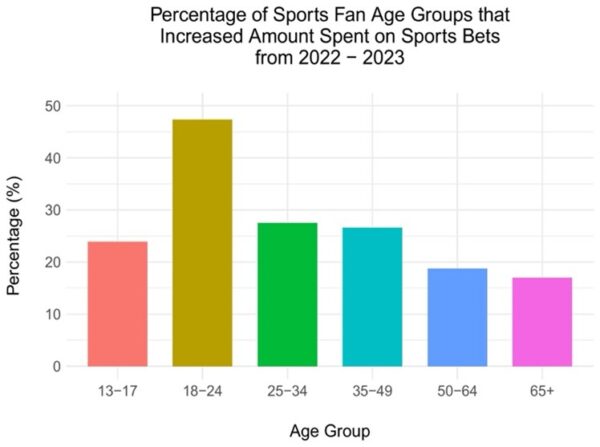

In 2023, around 20% of gamblers indicated they planned to spend more over the course of the year. This is driven by sports gamblers within the 18-34 age demographic, translating to growth opportunities among younger consumers for sports gambling companies. Almost 50% of 18-34 year old sports gamblers intend to spend more in the coming twelve months than they did in the previous year.

Sports gambling is here to stay and shows no signs of disappearing. With nearly 20 states still not legalizing online sports betting, there will be plenty of low-hanging fruit for online gambling operators to pursue once these states come online. The challenge remains: what happens after the low-hanging fruit has been picked? Where will online gambling operators turn to expand their business? The answer is clear based on the data from the SBRnet annual study of sports fans. Younger consumers, particularly those aged 18-24, and even those aged 13-17, demonstrate a high propensity to gamble on sports.

In examining the future of sports gambling, we conducted an in-depth analysis of seven out of the 19 sports measured by SBRnet. In nearly every instance, we were able to project into the next five years and anticipate that gains in gambling among 13-17 year olds fans would range from a low in the single-digit range to the low double-digit range, depending on the specific sport. Women’s sports, tennis, and auto racing are among the sports projected to experience the largest gains within this younger, underage demographic over the next five years.

The fact that sports gambling is growing rapidly among younger fans has many states concerned about its addictive properties, as noted in multiple medical journals. Access to technology, streaming media, broadband, and various online and mobile apps that can take bets and process credit cards or direct debits from checking accounts poses a significant danger to young consumers who view sports gambling as a fun and easy way to enhance their enjoyment while watching sporting events.

According to an article produced by the by the Mayo Clinic in March of 2024,

Making a small wager on a game is fun and harmless for many people. The problem with gambling is the subtle way it can take over your behavior and sensibility. This change can happen slowly or quite rapidly depending on a number of variables. However, the outcomes tend to be the same: damage to your relationships, bank accounts, credit rating, and overall mental and physical health.

The article continues:

The act of gambling has a powerful effect on the human mind. Wagering can create a compulsive dynamic, affecting your mental, emotional and physical health. If your gambling tips over to addiction, it changes the way the brain operates, leading to a real need for help.

According to the Diagnostic and Statistical Manual of the American Psychiatric Association, the criteria for a gambling disorder is persistent, recurrent problematic gambling behavior leading to clinically significant impairment or distress.

With insights from one of America’s leading medical institutions in mind, let’s examine the sports gambling habits of fans aged 18 to 24. Sports gamblers in this age group represent approximately 12% of all sports gamblers. More concerning, over 40% of them intend to spend more in the coming year than they did previously, according to data from SBRnet’s annual study of sports fans. To provide context, just over 20% of underage gamblers aged 13 to 17 also indicate they plan to increase their spending in the upcoming year compared to the last. Roughly 2.4% of all sports gamblers, or about 831,000 individuals, belong to the 13-17 year old demographic. This figure should be closely monitored by gambling operators, various organizations, and state gambling commissions responsible for industry regulation. The chart below clearly illustrates who plans to spend more on sports gambling.

The Sports Gambling Marketing Conundrum

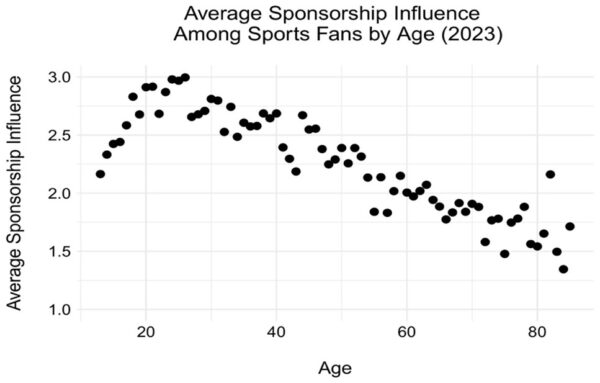

A number of states are currently looking very closely at the sports gambling industry and its specific tactics, which fuel sports gambling growth among younger fans especially those underage. Some states are concerned that giving away “free money” is a tactic that younger minds cannot properly evaluate, which could lead to a bad outcome for younger sports fans. The chart below looks closely at what is referred to as “sponsorship Influence” in terms of both in-stadium and traditional TV and digital video advertising. As the chart shows, younger fans are more influenced by messaging during games across all sports, as measured by SBRnet in its annual study of sports fans.

Sponsorship influence explains how fans are influenced by sponsor messaging they are exposed to at live events and/or traditional/streaming viewing. This uses a 5-point scale to measure.

Gambling on sports started back during ancient Rome and continues to this day. The evolution and growing saturation of broadband makes sports gambling as easy as taking out your phone. While sports gambling operators have been great at acquiring new gamblers, the question remains whether the growth and demand for online sports betting will take on a different strategy to continue to be popular or will states clamp down on the current “free money” strategies that target underage consumers?

Neil Schwartz, President of SBRnet, Inc, has more than two decades of marketing & consumer research experience in the sports, fitness and active lifestyle categories. Previously, Neil has worked for SportScanInfo from SportsOneSource in addition to heading the research team at the Sports & Fitness Industry Assoc. (SFIA). Neil has been a featured speaker at many industry conferences and events. He is also well respected for his work with leading financial and investment firms, top brands and retailers in the sports footwear and apparel categories. As President of SBRnet, Neil is committed to growing the use of data throughout the academic and related commercial categories of sports management, sports business, sports marketing and sports analytics. Neil is also one of the owners and creators of the Get in the Game sports business industry event that is focused on students of color at HBCU (s) and other colleges and universities around the country. Neil is a graduate of Syracuse University with a major in Communications and Business.

Neil Schwartz, President of SBRnet, Inc, has more than two decades of marketing & consumer research experience in the sports, fitness and active lifestyle categories. Previously, Neil has worked for SportScanInfo from SportsOneSource in addition to heading the research team at the Sports & Fitness Industry Assoc. (SFIA). Neil has been a featured speaker at many industry conferences and events. He is also well respected for his work with leading financial and investment firms, top brands and retailers in the sports footwear and apparel categories. As President of SBRnet, Neil is committed to growing the use of data throughout the academic and related commercial categories of sports management, sports business, sports marketing and sports analytics. Neil is also one of the owners and creators of the Get in the Game sports business industry event that is focused on students of color at HBCU (s) and other colleges and universities around the country. Neil is a graduate of Syracuse University with a major in Communications and Business.

Related Research

Wunderman Thomspon: B2B Ecommerce Benchmarking Report

Digital commerce is both a differentiator and a great equalizer. Since we’ve began compiling this report 8 years…

Women’s Sports: The Winning Play for Your Brand

Advertisers, brands, and sponsors can no longer overlook women’s professional and college sports when developing their marketing plans.…

Women in the Workplace

LeanIn.Org and McKinsey & Company looks at the state of women in corporate America. The report also includes steps companies can follow to create a more fair and inclusive work environment for women.