For decades, the 4As has championed the federal deductibility of advertising—a critical tax deduction for America’s businesses. But the fight isn't over. In 2017, the 4As and other allied partners successfully defended the preservation of this deduction against proposals to help pay for Trump's Tax Cuts and Jobs Act (TCJA). Now, with many TCJA provisions expiring in 2025 and the national deficit looming, the threat may be back. Any industry, including advertising, could once again be on the table during 2025 tax reform negotiations.

And the threat of new taxes is not just in Washington. Cash-strapped states are aggressively targeting the advertising industry for additional revenue. The industry has seen various state attempts to eliminate the sales and use tax exemption for advertising services and new proposals to impose taxes on third-party data providers and data use. Maryland's 2021 digital ad tax was just the beginning. As states grapple with increasing economic pressures, expect a wave of new tax bills on advertising in 2025 and beyond.

The 4As is committed to defending the favorable tax treatment of advertising, for the sake of our industry, but also for the sake of America’s economy. Stay informed. Stay protected.

U.S. Advertising: An Economic Growth Engine and Significant Job Creator

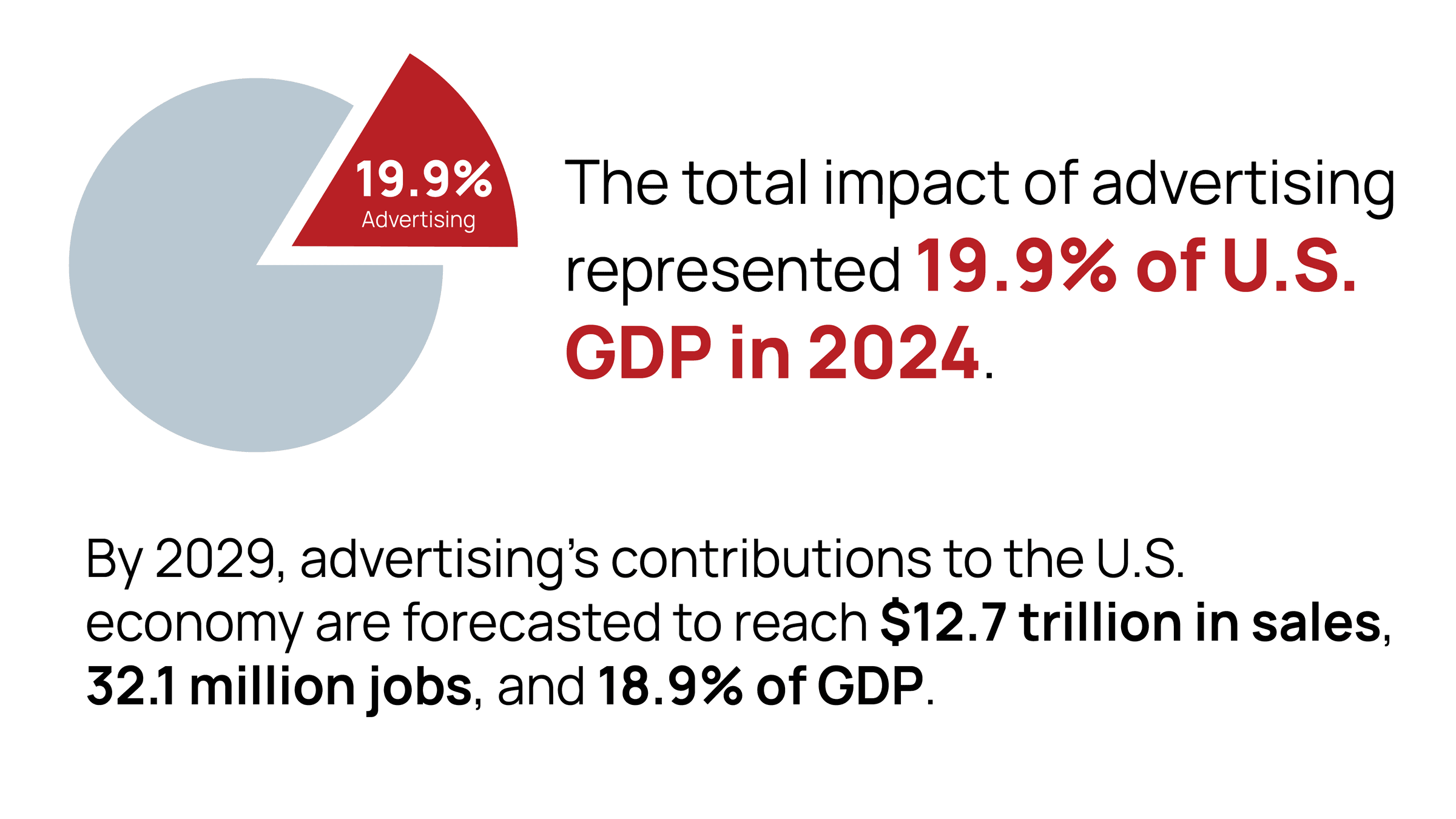

The proof is in the data. New research supported by the 4As and the Advertising Coalition (TAC) reveals the undeniable economic power of advertising, fueling trillions in U.S. sales and supporting tens of millions of American jobs. Take a look!

The Economic Impact of Advertising of the U.S. Economy 2024-2029

The Advertising Coalition

The Advertising Coalition is an alliance of the nation’s leading media companies and trade organizations broadly representing advertising-centric businesses and interests across the country. The coalition, of which the 4As is a founding member, advocates to preserve the current federal tax treatment of advertising as a normal business expense–fully deductible in the year it is spent. We engage legislators in Washington and in their districts to help them understand why preserving the federal advertising tax deduction is critical to our industry and U.S. growth and competitiveness.

For more than a hundred years, the current federal advertising tax deductibility paradigm has ensured that American businesses can use advertising to find consumers and compete. Today, it continues to create and support billions of dollars of U.S. economic sales and millions of American jobs. Proposals to alter the current tax treatment of advertising would create a significant economic distortion, threaten existing jobs, and diminish future job growth.

Learn more about The Advertising Coalition.

Blogs

02/24/2023

2023 Tax Changes for Software and Digital Goods

Login to access member-exclusive content Not a 4As member yet? Don’t miss out. Learn more about joining a growing…

02/24/2023

Digital Advertising Tax Bills Introduced in New York, Connecticut, and Massachusetts in 2023; California Could Be Next

Login to access member-exclusive content Not a 4As member yet? Don’t miss out. Learn more about joining a growing…

02/24/2023

Washington DOR Finds Advertising Agency Operators Liable for B&O, Sales Tax on Advancements and Reimbursements

Login to access member-exclusive content Not a 4As member yet? Don’t miss out. Learn more about joining a growing…

02/24/2023

Massachusetts Rules that Wayfair Cannot Be Applied Retroactively for Web Cookies

Login to access member-exclusive content Not a 4As member yet? Don’t miss out. Learn more about joining a growing…

01/11/2023

IRS Releases Guidance on Corporate Alternative Minimum Tax

Login to access member-exclusive content Not a 4As member yet? Don’t miss out. Learn more about joining a growing…

12/16/2022

Government Relations – December 2022 Newsletter

With 2022 almost coming to a close, the end-of-year chaos and impacts of procrastination that routinely affect Congress…

- « Previous

- 1

- 2

- 3

- 4

- Next »