For decades, the 4As has championed the federal deductibility of advertising—a critical tax deduction for America’s businesses. But the fight isn't over. In 2017, the 4As and other allied partners successfully defended the preservation of this deduction against proposals to help pay for Trump's Tax Cuts and Jobs Act (TCJA). Now, with many TCJA provisions expiring in 2025 and the national deficit looming, the threat may be back. Any industry, including advertising, could once again be on the table during 2025 tax reform negotiations.

And the threat of new taxes is not just in Washington. Cash-strapped states are aggressively targeting the advertising industry for additional revenue. The industry has seen various state attempts to eliminate the sales and use tax exemption for advertising services and new proposals to impose taxes on third-party data providers and data use. Maryland's 2021 digital ad tax was just the beginning. As states grapple with increasing economic pressures, expect a wave of new tax bills on advertising in 2025 and beyond.

The 4As is committed to defending the favorable tax treatment of advertising, for the sake of our industry, but also for the sake of America’s economy. Stay informed. Stay protected.

U.S. Advertising: An Economic Growth Engine and Significant Job Creator

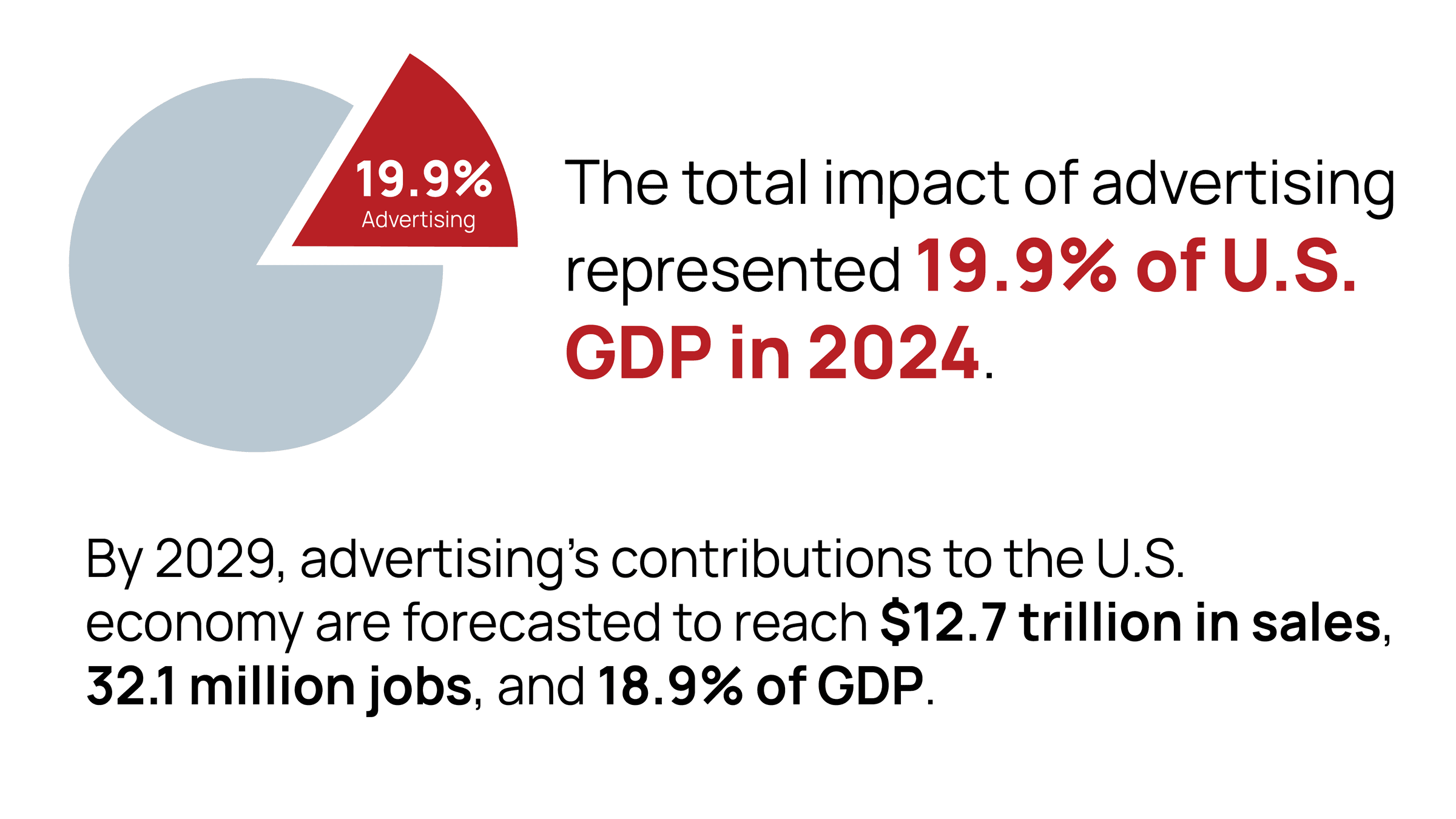

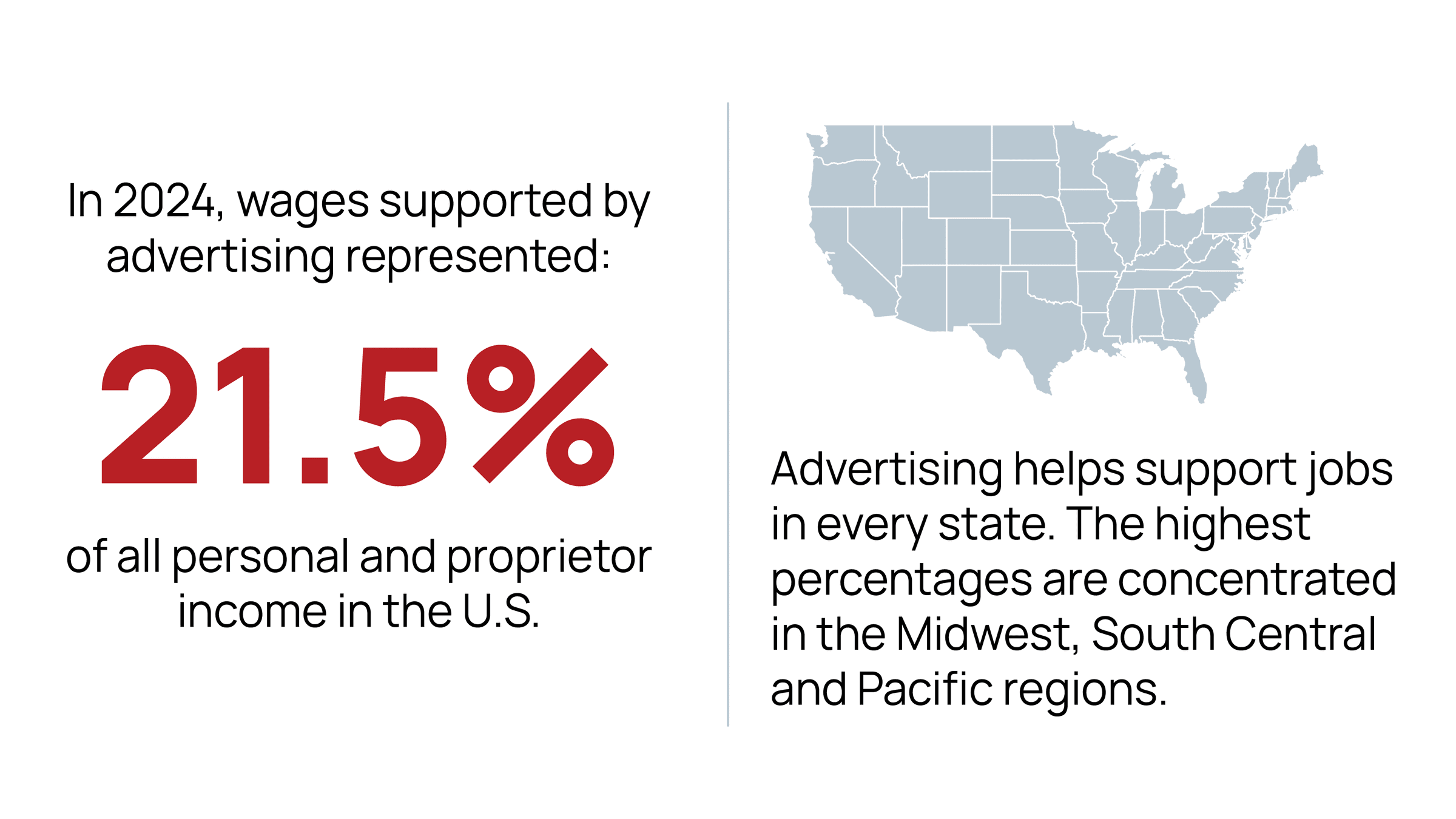

The proof is in the data. New research supported by the 4As and the Advertising Coalition (TAC) reveals the undeniable economic power of advertising, fueling trillions in U.S. sales and supporting tens of millions of American jobs. Take a look!

The Economic Impact of Advertising of the U.S. Economy 2024-2029

The Advertising Coalition

The Advertising Coalition is an alliance of the nation’s leading media companies and trade organizations broadly representing advertising-centric businesses and interests across the country. The coalition, of which the 4As is a founding member, advocates to preserve the current federal tax treatment of advertising as a normal business expense–fully deductible in the year it is spent. We engage legislators in Washington and in their districts to help them understand why preserving the federal advertising tax deduction is critical to our industry and U.S. growth and competitiveness.

For more than a hundred years, the current federal advertising tax deductibility paradigm has ensured that American businesses can use advertising to find consumers and compete. Today, it continues to create and support billions of dollars of U.S. economic sales and millions of American jobs. Proposals to alter the current tax treatment of advertising would create a significant economic distortion, threaten existing jobs, and diminish future job growth.

Learn more about The Advertising Coalition.

Blogs

06/13/2024

State and Federal Advertising Tax Update – June 2024

Login to access member-exclusive content Not a 4As member yet? Don’t miss out. Learn more about joining a growing…

11/09/2023

Government Relations – November 2023 Newsletter

While politics is undoubtedly getting more and more unusual these days, dysfunction in Washington is not in short…

03/01/2023

4As March 2023 Tax Update

Login to access member-exclusive content Not a 4As member yet? Don’t miss out. Learn more about joining a growing…

02/24/2023

EU Official Confirms EU Is Exploring Revising Digital Services Tax Without Global OECD Deal on Digital Services

Login to access member-exclusive content Not a 4As member yet? Don’t miss out. Learn more about joining a growing…

02/24/2023

OECD Releases Technical Guidance on Global Minimum Tax Pillar Two

Login to access member-exclusive content Not a 4As member yet? Don’t miss out. Learn more about joining a growing…

02/24/2023

Federal Corporate Alternative Minimum Tax Established in 2022; IRS Interim Guidance Issued

Login to access member-exclusive content Not a 4As member yet? Don’t miss out. Learn more about joining a growing…