Author

Mark Green & Carol Hinnant

MediaBrain, Inc.

Topic

- Media

- Media Measurement

- Privacy

- Reporting & Analytics

- Research

Marketers and their agencies are increasingly pressed to make advertising investment decisions and real time adjustments across a continuously evolving array of media options to drive marketing performance. The fundamental challenge has become the operational costs of doing this effectively in tandem with managing relations with their customers.

To date, most marketers have outsourced these activities to agencies to gain the efficiency of shared resources. Agencies share these costs across many non-competing advertisers. These costs are ballooning as agencies attempt to plan and buy each new medium, each of which requires new measurements and toolsets to make sense of them. Then additional staffing and toolsets are required to plan holistically across this increasingly fragmented landscape.

Business Challenges

The primary business challenges are:

- To resource dedicated math and engineering teams to integrate evolving measurement sources into an analytic framework that evaluates combinations of investments across and within media, including optimizing pricing decisions, monitoring performance, and making real time adjustments.

- To continually restructure brand management teams to plan, buy, and monitor media investments, as the media and technologies to evaluate the media change.

Data Challenges

On data, the three basic challenges are:

- Media and their associated measurements are now working in a multi-measurement world that must continue to evolve to follow consumer behaviors.

- Data privacy laws create integration complexities.

- Data ownership adds to integration complexities.

Recent media evolutions include YouTube and streamers consuming over the air broadcast and cable network audiences, and newbie TikTok, which may or may not go dark shortly, consumes both social and video audiences. Consumption is becoming more individualized, while publishing is becoming more algorithmic.

Previous media measurement evolutions saw the transition from sampling based measurements that effectively reported the consumption of broadcast communications big data, census based measurements to account for the vast variety of individualized consumption patterns. Recent evolutions involve integrating surveys with the big data sources and a plethora of first party trackers. Next, the sunsetting of cookies in tandem with the growing power of machine learning will seed the rise of synthetic data.

Privacy has led to consumer information being led to agencies and marketers managing their own consumer databases, appending behaviors and attributes to enhance them, and then linking them via clean rooms to media platforms to evaluate, activate, and monitor marketing investments. These consumer databases are now known as identity spines.

In addition to privacy requirements, ownership is driven by business strategy. Many media companies jealously guard their return path data consumption data. Large retailers and marketers also do so. These practices make cross platform and even cross publisher analytics complicated and expensive with all the clean rooms and missing data modeling necessary per identity spine.

Overall, the complexities fostered by evolving media, measurements, privacies, and ownerships are too much for Brand Managers to make decisions on without a smart console that automates everything or a managing director with an army of silo specialists.

Solution Types

There are two dimensions to solution options.

- Data.

- Staffing and tools.

On data, marketers and agencies can build, integrate, and maintain identity spines, or subscribe to lower cost survey equivalents. Dropping compute costs along with innovations in machine learning and synthetic analytics of combinations of data sources, including sufficient volumes of standardized consumer return path data, may see lower cost equivalents start competing with the effectiveness of the identity spine approach soon.

Sellers, on the other hand, will continue to build and maintain identity spines for their own data and then plug into third party aggregators, like Comscore, and/or small survey companies, like MRI/Simmons, and/or the large survey / synthetic data companies coming soon, and/or programmatic exchanges and portals, like The Trade Desk, to make their data actionable in both negotiated and programmatic sales.

On staffing and tools, tools will determine staffing needs.

Currently, marketers and agencies have a strategy team to handle investment planning along with downstream buying teams for each media platform. For marketers and agencies that deal in identity spines, they also maintain teams of data scientists and software engineers to wrangle, integrate, and maintain the data feeds and put on front-ends to make sense of them.

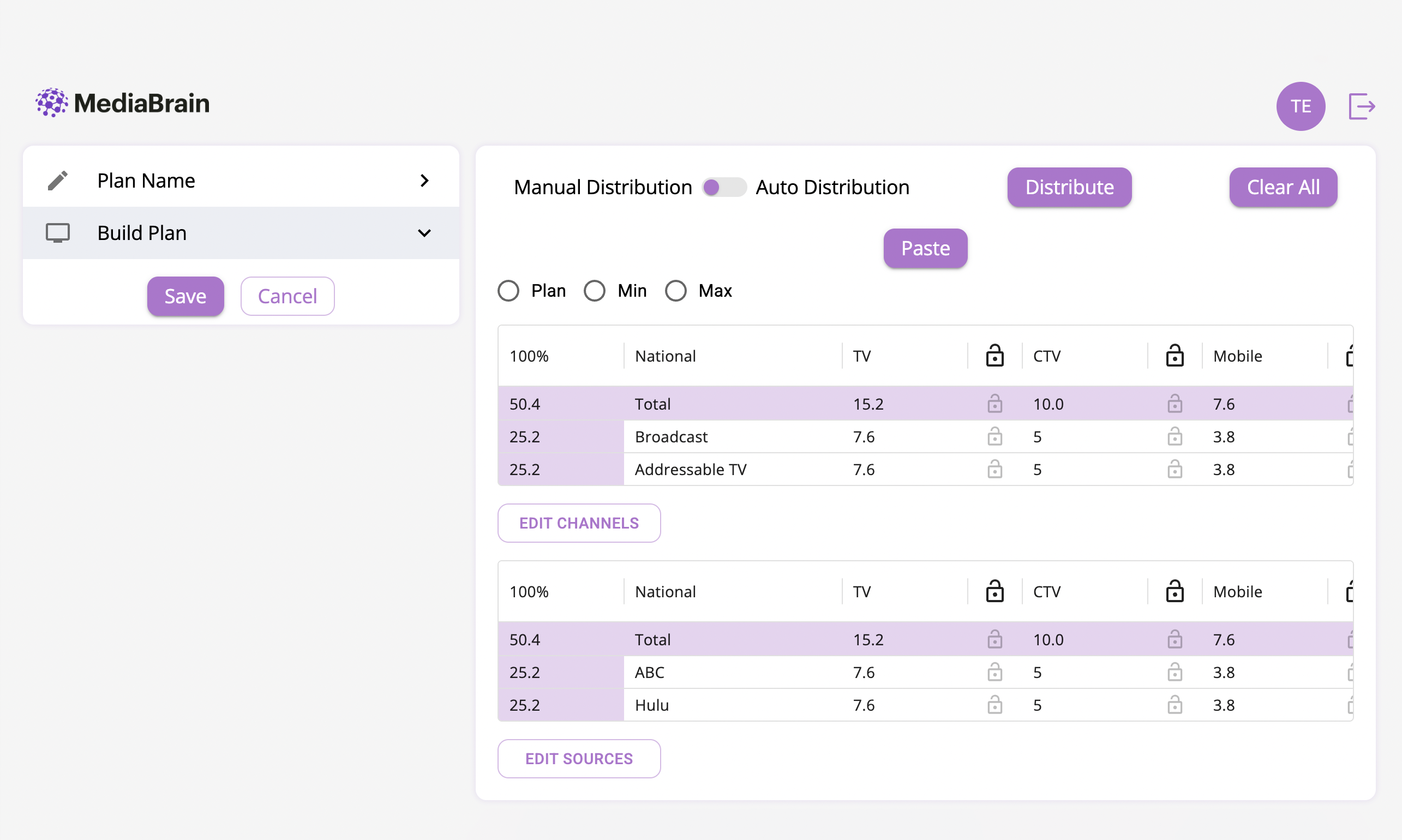

Alternatively, marketers and agencies can subscribe to a tool that has cross media planning, buying, and performance monitoring that allows for real time adjustments in a single console. This approach reduces staffing requirements, as one Brand Manager can now oversee the media analytics, investments, and performance from a single console with all the previously staffed work handled by intelligent automations. This includes automations for integrations, forecasting, and advice on planning investments, buying, and performance management.

Automated forecasting and intelligence is where all the data are integrated, the analytics are automated, futures are estimated, daily intelligence on market conditions are summarized, buying and pricing recommendations are made, and advice for daily adjustments are reported.

For sellers, these would be consoles for the sales staff, switching from buy recommendations to sell recommendations that maximize the yields across linear and addressable assets. The servicing of these sales would also be automated with supply side performance reporting and adjustments.

If you are interested in more information or discussion on Cross Platform Planning, Automated Intelligence, Identity Spines, Synthetic Data, or any of the other topics touched on in the viewpoint, please contact us at [email protected] and join our Round Table of interested leaders.

About MediaBrain

MediaBrain’s mission is to make media performance easy.

MediaBrain technologies enable media buyers and sellers to analyze, plan, buy, and monitor media performance from a single console to efficiently transact in today’s cross platform world. The technologies empower organizations to streamline operations with AI assisted automated intelligence, integrating client data with third party data and media measurements using advanced cloud storage, computing, and clean room technologies.